Understanding Self Assessment Re-Registration: Your Starting Point

Why Do I Need to Re-Register for Self Assessment?

Now, if you’re scratching your head wondering why you need to re-register for Self Assessment, let’s clear the fog. Re-registering is HMRC’s way of getting you back on their radar if you’ve previously filed a tax return but stopped, or if new income sources—like freelancing or rental properties—mean you need to start filing again. It’s not about starting from scratch; it’s about reactivating your tax obligations. For the 2025/26 tax year, you must notify HMRC by 5 October 2025 if you had untaxed income in the 2024/25 tax year (6 April 2024 to 5 April 2025) that requires a return. Miss this, and you could face a “failure to notify” penalty—up to 30% of the tax owed.

Who Needs to Re-Register?

Let’s break it down. Not everyone needs to re-register, but certain situations trigger this requirement. If you’ve filed a Self Assessment return before but didn’t send one last year (e.g., you paused freelancing), HMRC expects you to re-register to reactivate your account. The same goes if you’re picking up new untaxed income. Here’s who typically needs to jump back in:

- Sole traders restarting self-employment with earnings over £1,000 (before expenses).

- Landlords earning more than £2,500 net (or £10,000 gross) from UK property.

- High earners (over £100,000) or those liable for the High Income Child Benefit Charge (£60,000+ income).

- Anyone with untaxed income, like foreign earnings, dividends, or tips over £1,000.

HMRC’s online tool can confirm if you need to file, but don’t skip this step—11.7 million people filed Self Assessment returns for 2022/23, so you’re not alone.

What Are the Key Deadlines and Tax Rules for 2025/26?

Now, let’s talk numbers and dates. For the 2025/26 tax year, the personal allowance remains £12,570, meaning you pay no income tax on earnings below this. Above that, tax bands kick in: 20% (basic rate, up to £50,270), 40% (higher rate, up to £125,140), and 45% (additional rate). If you’re self-employed, you’ll also pay Class 4 National Insurance at 6% on profits between £12,570 and £50,270, then 2% above that. Voluntary Class 2 contributions are £3.50 per week to protect your National Insurance record. Deadlines are non-negotiable:

- 5 October 2025: Register or re-register with HMRC.

- 31 October 2025: Submit paper tax returns.

- 31 January 2026: File online returns and pay tax owed.

Miss these, and penalties start at £100 for late filing, escalating to 3–10% of tax owed for late registration.

Table 1: Self Assessment Triggers and Deadlines for 2025/26

| Trigger | Description | Registration Deadline | Filing Deadline |

|---|---|---|---|

| Self-Employment | Earnings > £1,000 (pre-expenses) | 5 October 2025 | 31 January 2026 (online) |

| Rental Income | Net > £2,500 or gross > £10,000 | 5 October 2025 | 31 January 2026 (online) |

| High Income | Total income > £100,000 | 5 October 2025 | 31 January 2026 (online) |

| Child Benefit Charge | Income > £60,000 with Child Benefit | 5 October 2025 | 31 January 2026 (online) |

| Untaxed Income | Tips, dividends, foreign income > £1,000 | 5 October 2025 | 31 January 2026 (online) |

Source: GOV.UK, verified July 2025

What Happens If I Don’t Re-Register?

Be careful! Skipping re-registration can land you in hot water. HMRC can issue a “failure to notify” penalty, calculated as a percentage of the tax you owe—30% if you’re over a year late, though it drops to 0% if you file and pay by 31 January 2026. Interest also accrues on unpaid tax from 1 February 2026 at 7.75% (as of July 2025). For example, Bronwen, a Cardiff freelancer, restarted her graphic design business in June 2024 but forgot to re-register by October 2025. She owed £2,000 in tax, faced a £600 penalty, and racked up £50 in interest by March 2026. Appealing penalties is possible if you have a “reasonable excuse” (e.g., serious illness), but HMRC is strict.

Why Re-Register If I’ve Filed Before?

Here’s the deal: If you’ve filed a Self Assessment return in the past, HMRC assumes you’re still in the system unless you explicitly tell them you’ve stopped (e.g., by deregistering as self-employed). But if you didn’t file last year—say, because you took a break from freelancing—you need to re-register to reactivate your UTR and get a notice to file. This ensures HMRC knows you’re back in the game. Even if you have a UTR, notifying HMRC by 5 October 2025 is critical to avoid penalties. Bronwen, for instance, had a UTR from 2018 but needed to re-register because she hadn’t filed since 2019.

How Does This Fit Into My Tax Planning?

Now consider this: Re-registering isn’t just about compliance—it’s a chance to get your tax affairs in order. By re-registering early, you can start tracking allowable expenses (e.g., home office costs, travel) to reduce your tax bill. For instance, if you’re a sole trader, you can claim simplified expenses, like £26 per month for working from home. Early re-registration also gives you time to budget for “payments on account” (advance tax payments due 31 January and 31 July). In 2023/24, HMRC collected £18.4 billion from Self Assessment, so they’re serious about enforcement.

Your Roadmap to Re-Registering with HMRC

How Do I Start the Re-Registration Process?

Now, let’s get down to brass tacks—re-registering for Self Assessment isn’t as daunting as it sounds, but it does require some legwork. Whether you’re a freelancer picking up where you left off or a landlord with new rental income, HMRC needs to know you’re back in the tax return game. The process varies slightly depending on your situation—sole trader, partnership, or just someone with untaxed income—but the core steps are straightforward. You can re-register online, by post, or (in rare cases) by phone. Most people will use HMRC’s online portal, which is the fastest way to get your Unique Taxpayer Reference (UTR) reactivated or issued. Let’s walk through the steps and tackle some common hurdles.

What Forms Do I Need to Re-Register?

Here’s the deal: The form you use depends on why you’re re-registering. If you’re restarting as a sole trader, you’ll need the CWF1 form, which registers you as self-employed and covers National Insurance contributions. For non-self-employed individuals—say, you’ve got rental income or dividends—you’ll use the SA1 form. If you’re part of a partnership, it’s the SA400 form for the partnership itself, plus SA401 for each partner. These forms tell HMRC why you’re back in the Self Assessment system. You can find them on GOV.UK, and most can be submitted online via the Government Gateway. For example, Sanjay, a non-resident landlord living in Dubai, used the SA1 form in 2024 to re-register after buying a second rental property in Manchester.

How Do I Set Up a Government Gateway Account?

Now, if you’re going the online route (and you should, it’s quicker), you’ll need a Government Gateway account. If you’ve filed Self Assessment before, you might already have one, but don’t assume it’s active—accounts can be deactivated after a period of inactivity. To set one up or reactivate:

- Visit GOV.UK’s registration page.

- Provide your email, name, and a password (make it strong, HMRC’s picky).

- You’ll get a Government Gateway ID (12 digits) and an activation code sent by post within 10 working days.

If you’ve lost your old Gateway ID, use HMRC’s recovery tool with your National Insurance number or old UTR. Sanjay, for instance, had to recover his Gateway ID from 2019, which took a week but saved him from starting over.

What If I’ve Lost My UTR?

Be careful! Your Unique Taxpayer Reference (UTR) is your tax lifeline—a 10-digit number HMRC uses to track you. If you’ve filed before, you already have one, but losing it is common, especially after a long break. To recover it:

- Log into your Government Gateway account and check under “Self Assessment details.”

- If you can’t log in, use HMRC’s online UTR finder with your National Insurance number or passport details.

- Alternatively, call HMRC’s Self Assessment helpline (0300 200 3310, open 8am–6pm, Monday–Friday).

It can take 15 working days to get a replacement UTR by post, so don’t delay. In 2024, HMRC processed 1.2 million UTR-related queries, so expect some wait time during peak periods (September–October).

Can I Re-Register Online, by Post, or Phone?

Let’s weigh your options. Online registration is the gold standard—95% of Self Assessment registrations in 2023/24 were digital, per HMRC. It’s fast, trackable, and lets you manage your tax affairs in one place. Here’s how the methods compare:

Table 2: Comparison of Self Assessment Registration Methods

| Method | Pros | Cons | Processing Time |

|---|---|---|---|

| Online (Government Gateway) | Fast, trackable, integrates with tax account | Requires internet, activation code takes 10 days | 10–15 working days for UTR |

| Post (CWF1/SA1/SA400) | No internet needed, suits complex cases | Slower, risk of postal delays | 2–4 weeks |

| Phone (0300 200 3310) | Quick for simple queries, human support | Long hold times, limited to basic cases | 15–20 working days |

Source: GOV.UK, verified July 2025

If you’re digitally excluded (e.g., no internet or printer), post is viable—download forms from GOV.UK, fill them out, and send to HMRC’s Freepost address. Phone registration is a last resort; HMRC often directs you online or to post for complex cases.

How Long Does It Take to Get a UTR?

So, the question is: When will you be ready to file? After re-registering, HMRC typically sends your UTR (or reactivates your old one) within 10–15 working days for online submissions, or 2–4 weeks for postal. If you’re a non-resident like Sanjay, allow an extra week for international post. Once you have your UTR, HMRC will issue a “notice to file” by email or post, confirming your tax return is due by 31 January 2026 (online) or 31 October 2025 (paper). If delays hit—say, during HMRC’s busy October period—call the helpline to confirm receipt. Sanjay waited 18 days for his UTR in 2024 due to a postal backlog but avoided penalties by registering before 5 October.

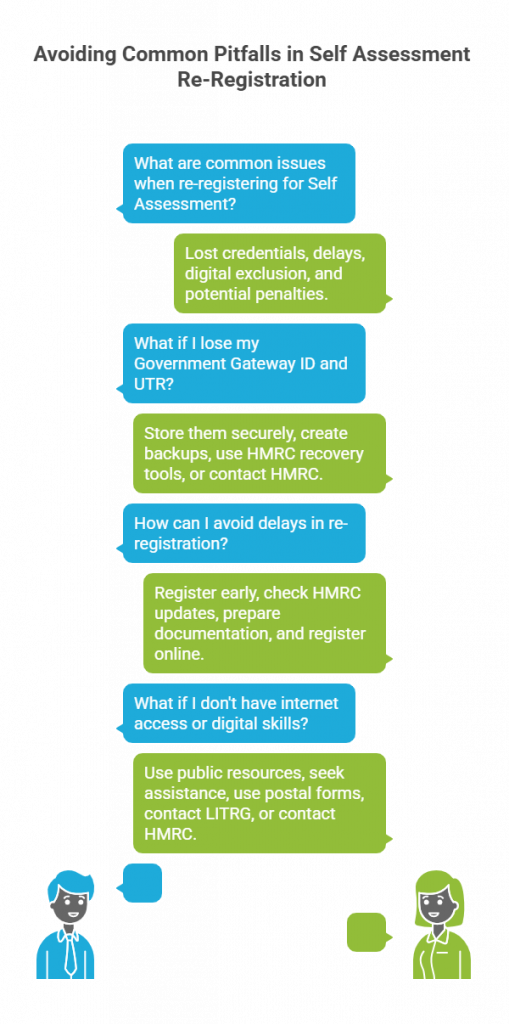

What Are the Common Pitfalls and How Do I Avoid Them?

Now, let’s be honest—re-registering isn’t always smooth sailing. Here are common hiccups and how to dodge them:

- Lost credentials: Keep your Government Gateway ID and UTR in a secure place (e.g., a password manager). If lost, use HMRC’s recovery tools early.

- Delays: Register by mid-September to beat the 5 October rush. In 2023, HMRC reported 20% of October registrations faced delays due to high demand.

Dakota: Digital exclusion: If you lack internet access, ask a friend or use a library for online registration, or opt for postal forms. The Low Incomes Tax Reform Group offers free support for vulnerable taxpayers. - Penalties: If you miss the 5 October deadline, file your return by 31 January 2026 to minimize penalties. If penalized unfairly, appeal via your Government Gateway account with a “reasonable excuse” (e.g., bereavement, tech issues).

For example, Sanjay faced a delay because he didn’t have a UK address for the activation code. He used a friend’s Manchester address, which HMRC accepted after verifying his identity.

How Do I Know If I’m Registered Correctly?

Here’s a quick tip: Once you’ve submitted your form (online or post), check your HMRC Business Tax Account online. It’ll show your Self Assessment status as “active” and list your UTR. If you don’t see this within 20 working days, call HMRC to confirm. You’ll also get a confirmation letter or email from HMRC, so keep an eye on your inbox (and junk folder). Sanjay missed his confirmation email because it went to spam, but a quick call to HMRC sorted it.

Navigating Life After Self Assessment Re-Registration

What Happens After I Re-Register?

Now, let’s talk about what comes next—you’ve re-registered, your UTR is active, and HMRC knows you’re back in the Self Assessment game. The real work starts here: filing your first tax return, managing payments, and staying on HMRC’s good side. After re-registering by 5 October 2025, you’ll typically receive a “notice to file” from HMRC within 10–15 working days, confirming your tax return is due for the 2024/25 tax year (6 April 2024 to 5 April 2025). This notice arrives via email or post and includes your UTR and filing instructions. For the 2025/26 tax year, you must file online by 31 January 2026 (or 31 October 2025 for paper returns) and pay any tax owed. In 2023/24, HMRC processed 11.7 million Self Assessment returns, so expect a busy system as deadlines approach.

How Do I Prepare for My First Tax Return?

Here’s the deal: Your first tax return after re-registering can feel like navigating a maze, but it’s manageable with preparation. Start by gathering records of your income and expenses—think invoices, receipts, bank statements, and mileage logs. If you’re self-employed, track allowable expenses like office supplies or travel costs to reduce your taxable income. For example, Cerys, a partner in a Swansea catering partnership, re-registered in 2024 after a two-year hiatus. She used accounting software to log £3,000 in kitchen equipment costs, slashing her tax bill by £600 at the 20% basic rate. You’ll also need your National Insurance number and UTR to file. HMRC’s online tax return tool guides you through the process, but start early—January is chaotic.

What Are Payments on Account and How Do They Work?

Now, let’s tackle a tricky bit: payments on account. If your tax bill for 2024/25 exceeds £1,000 and less than 80% of your income is taxed at source (e.g., via PAYE), HMRC expects you to make advance payments toward your next year’s tax. These are due on 31 January and 31 July each year. For instance, if Cerys owes £2,000 for 2024/25, she’d pay £1,000 on 31 January 2026 (for 2024/25) plus £1,000 as a “payment on account” for 2025/26. If her next year’s bill is lower, she can claim a refund or reduce payments via HMRC’s online portal. In 2023/24, 3.2 million taxpayers made payments on account, so it’s common but often catches people off guard.

How Do National Insurance Contributions Fit In?

Be careful! If you’re self-employed, re-registering also means dealing with National Insurance (NI). You’ll likely pay Class 2 NI (£3.50/week, voluntary for 2025/26) to maintain your state pension eligibility and Class 4 NI (6% on profits between £12,570 and £50,270, 2% above that). These are calculated when you file your tax return and paid with your income tax. Cerys’s partnership, for example, paid £400 in Class 4 NI on £10,000 profits in 2024/25. If you’re not self-employed but re-registered forbru other income (e.g., rental), NI may not apply, but check with HMRC’s helpline (0300 200 3310) to confirm. Missing NI contributions can affect your pension, so don’t skip this.

What Expenses Can I Claim to Reduce My Tax Bill?

Now, here’s a silver lining: claiming allowable expenses can significantly cut your tax. Sole traders and partnerships can deduct costs directly related to their business, like:

- Office costs: £26/month simplified expense for working from home.

- Travel: 45p/mile for the first 10,000 miles, 25p after.

- Equipment: Laptops, tools, or machinery (check capital allowances).

- Professional fees: Accountancy or legal costs.

Landlords can claim repairs, management fees, or mortgage interest (up to a 20% tax credit). In 2024, Cerys claimed £1,200 in travel expenses, reducing her taxable profit. Keep records, as HMRC may audit you up to six years later. The table below lists common expenses:

Table 3: Typical Self Assessment Expenses and Reliefs

| Expense Type | Description | Eligibility | Max Claim (Example) |

|---|---|---|---|

| Home Office | Simplified expense for home use | Self-employed | £26/month |

| Travel | Mileage or public transport | Business-related | 45p/mile (first 10,000 miles) |

| Equipment | Computers, tools, furniture | Business use | 100% (via capital allowances) |

| Professional Fees | Accountancy, legal costs | Business-related | Actual cost |

| Property Repairs | Fixes to rental properties | Landlords | Actual cost |

Source: GOV.UK, verified July 2025

How Do I Avoid Penalties After Re-Registering?

Let’s be honest—nobody wants a penalty notice from HMRC. To stay compliant:

- File on time: Submit by 31 January 2026 (online) to avoid a £100 late filing penalty.

- Pay on time: Settle tax by 31 January 2026 to avoid 7.75% interest (as of July 2025).

- Appeal if needed: If you’re penalized unfairly (e.g., due to HMRC delays), submit an appeal via your Government Gateway account with evidence.

Cerys missed her 2024 filing deadline due to a family emergency but successfully appealed with a doctor’s note, avoiding a £100 fine. HMRC’s penalty guidance explains reasonable excuses, like illness or postal delays.

How Can I Budget for My Tax Bill?

Now consider this: A big tax bill can hit like a ton of bricks, especially if you’re new to Self Assessment. To avoid a January panic, set aside 20–30% of your untaxed income monthly in a separate savings account. For example, if you earn £2,000/month as a freelancer, save £400–£600. Use HMRC’s tax calculator to estimate your bill based on 2025/26 rates: £12,570 personal allowance, 20% tax on income up to £50,270, and so on. Cerys budgeted £5,000 for her 2024/25 bill, covering tax and NI, and avoided scrambling when payments on account came due.

Summary: 10 Key Points for Self Assessment Re-Registration

- Re-register by 5 October 2025 if you have new untaxed income or are resuming Self Assessment after a break.

- Use the CWF1 form for self-employment, SA1 for other income, or SA400/SA401 for partnerships.

- Set up or reactivate a Government Gateway account to re-register online, the fastest method.

- Recover a lost UTR via HMRC’s online tool or helpline to avoid delays in filing.

- Expect your UTR within 10–15 working days (online) or 2–4 weeks (post) after re-registering.

- File your first tax return by 31 January 2026 (online) to avoid a £100 penalty.

- Budget for payments on account (due 31 January and 31 July) if your tax bill exceeds £1,000.

- Pay Class 2 (£3.50/week) and Class 4 NI (6% on profits) if self-employed to maintain pension rights.

- Claim allowable expenses like travel or home office costs to reduce your taxable income.

- Save 20–30% of untaxed income monthly to cover your tax bill and avoid surprises.

FAQs

Q1: What is the difference between registering and re-registering for Self Assessment?

A1: Registering is for first-time filers notifying HMRC of new tax obligations, while re-registering applies to those who previously filed but stopped and now need to resume due to new or restarted untaxed income.

Q2: Can you re-register for Self Assessment if you’re not a UK resident?

A2: Non-UK residents must re-register if they have UK taxable income, such as rental income or self-employment earnings, using the SA1 form for individuals or SA400 for partnerships.

Q3: What happens if you re-register after the 5 October deadline?

A3: Late re-registration can lead to a “failure to notify” penalty of up to 30% of the tax owed, though penalties may be reduced if the tax return is filed and paid by 31 January.

Q4: Can you re-register for Self joining Assessment without a National Insurance number?

A4: Yes, but it’s harder; HMRC may accept alternative ID like a passport, though they’ll likely request additional verification to issue a UTR.

Q5: How does re-registering affect Child Benefit payments?

A5: Re-registering may trigger the High Income Child Benefit Charge if income exceeds £60,000, requiring repayment of some or all Child Benefit received.

Q6: What documents are needed to re-register for Self Assessment?

A6: You’ll need your National Insurance number, proof of identity (e.g., passport), and details of your income sources; partnerships also need partner details for the SA400 form.

Q7: Can you re-register for Self Assessment if you’re already on PAYE?

A7: Yes, if you have additional untaxed income (e.g., freelance work or rentals), you must re-register to report it, even if your main income is taxed via PAYE.

Q8: How do you know if you’ve been removed from Self Assessment previously?

A8: Check your Government Gateway account or contact HMRC’s helpline; they’ll confirm if you were deregistered due to inactivity or no filing requirement.

Q9: Can you re-register for Self Assessment for a previous tax year?

A9: You can notify HMRC of untaxed income from up to four previous tax years, but late registration may incur penalties depending on the delay.

Q10: What if you re-register but later find you don’t need to file a tax return?

A10: Contact HMRC to explain your situation; they may remove you from Self Assessment if your income falls below taxable thresholds.

Q11: Can partnerships re-register if only one partner has new income?

A11: The partnership must re-register using the SA400 form if it earns new taxable income, and all partners must also complete SA401 forms.

Q12: How does re-registering affect tax refunds?

A12: Re-registering ensures HMRC processes any overpaid tax from untaxed income, but refunds depend on your tax calculations and may take 6–8 weeks after filing.

Q13: Can you use an agent to re-register for Self Assessment?

A13: Yes, an accountant or tax agent can re-register on your behalf using their own Government Gateway credentials, with your authorization via Form 64-8.

Q14: What if you re-register but don’t receive a notice to file?

A14: Check your Government Gateway account or contact HMRC; delays can occur, but you’re still responsible for filing by the deadline even without the notice.

Q15: Can you re-register if you’re self-employed but below the £1,000 threshold?

A15: You don’t need to re-register if your self-employment income is below £1,000, as it’s covered by the trading allowance, unless you want to claim expenses.

Q16: How does re-registering affect VAT registration?

A16: Re-registering for Self Assessment is separate from VAT registration, which is required only if your taxable turnover exceeds £90,000 annually.

Q17: Can you appeal a penalty for late re-registration?

A17: Yes, you can appeal via your Government Gateway account or by writing to HMRC, providing a “reasonable excuse” like illness or technical issues.

Q18: What if you re-register but your income is from a non-UK source?

A18: You must re-register if the income is taxable in the UK (e.g., through a UK trade or property), with tax treaties determining any double taxation relief.

Q19: How do you update personal details during re-registration?

A19: Update details like your address or name in your Government Gateway account or on the re-registration form (e.g., CWF1 or SA1) before submitting.

Q20: Can you re-register for Self Assessment if you’re in a tax dispute with HMRC?

A20: Yes, you can re-register, but the dispute may delay processing; resolve the dispute via HMRC’s appeals process to ensure accurate tax records.