Understanding Tax Relief for Commuters from High Wycombe to London

So, you’re commuting from High Wycombe to London, clocking up those train fares and maybe wondering if there’s any way to claw back some of that cash through tax relief. Let’s dive straight into the heart of it: can you claim tax relief for your commute, and if so, how? The short answer is that, unfortunately, most commuters can’t claim tax relief for their daily journey to and from work. HMRC’s rules are pretty clear on this—ordinary commuting expenses, like train tickets or fuel for your car, don’t qualify for tax relief because they’re considered personal expenses, not work-related ones. But don’t lose hope just yet! There are specific scenarios where you might be able to claim something back, and I’ll walk you through them with all the details you need for the 2025/26 tax year.

Why Ordinary Commuting Doesn’t Qualify

Now, let’s get this straight: HMRC defines “ordinary commuting” as the regular travel between your home and your permanent workplace, like your daily slog from High Wycombe to London. According to their guidance, this doesn’t count as a business expense, no matter how pricey those train tickets get. The logic? You’d be living in High Wycombe (or wherever) anyway, so the cost of getting to work is on you. It’s a tough pill to swallow, especially with a season ticket from High Wycombe to London Marylebone costing around £5,500 annually in 2025, based on recent fare trends. But there are exceptions, and those are where we’ll focus to help you save some tax.

Exceptions to the Rule: Temporary Workplaces

Here’s a bit of good news: if your commute to London involves a temporary workplace, you might be eligible for tax relief. A temporary workplace is somewhere you attend for a limited time—say, less than 24 months—or for a specific project. For example, if you’re a High Wycombe-based IT consultant sent to a client’s office in London for a six-month gig, the train fares or mileage costs could qualify for relief. HMRC allows tax relief on travel expenses for temporary assignments because these are seen as necessary for your job, not just your daily routine. The catch? You need to prove it’s temporary, and if you end up staying longer than 24 months, HMRC might reclassify it as a permanent workplace, and the relief stops.

How to Calculate Travel Expense Relief

Let’s say you’re one of the lucky ones with a temporary workplace. How much can you claim? If you’re using your own car, HMRC’s Approved Mileage Allowance Payments (AMAP) rates for 2025/26 apply. For cars, it’s 45p per mile for the first 10,000 business miles annually, then 25p per mile after that. The round-trip from High Wycombe to central London is roughly 60 miles, so if you’re driving five days a week for a temporary job, that’s 300 miles weekly. Over a year (assuming 46 weeks to account for holidays), that’s 13,800 miles. Here’s how it breaks down:

| Mileage | Rate | Total Relief |

|---|---|---|

| First 10,000 miles | 45p/mile | £4,500 |

| Next 3,800 miles | 25p/mile | £950 |

| Total | £5,450 |

If you’re claiming this, the relief reduces your taxable income, so if you’re a basic rate taxpayer (20%), you’d save £1,090 in tax. For train commuters, you’d claim the actual cost of tickets, but only if the employer doesn’t reimburse you. Keep those receipts or digital tickets handy, as HMRC loves evidence.

Public Transport and Season Tickets

Now, if you’re taking the train, things get trickier. Most High Wycombe commuters rely on Chiltern Railways, with an annual season ticket to London costing around £5,500 in 2025. Sadly, you can’t claim tax relief on this unless your employer requires you to travel to a temporary workplace or covers specific business trips. If your employer reimburses your train fare for a temporary assignment, that reimbursement is tax-free as long as it’s for business purposes. But if you’re paying out of pocket for your regular commute, HMRC won’t budge. One workaround? Check if your employer offers a season ticket loan scheme—some companies provide interest-free loans for annual tickets, which can ease the upfront cost, even if it’s not tax-deductible.

Other Work-Related Expenses You Might Claim

Let’s not stop at travel. If you’re commuting for work, you might have other expenses that qualify for tax relief. For instance, if you’re required to wear a uniform or specific protective clothing (say, you’re a construction worker commuting to a London site), you can claim a flat-rate allowance for cleaning or maintaining it. For 2025/26, HMRC’s flat-rate allowance for uniforms is £60-£140 per year, depending on your industry, reducing your taxable income. Also, if your job requires you to buy tools or equipment without employer reimbursement, those costs might be deductible too. Always check HMRC’s list of allowable expenses for your profession.

Tax Codes and Emergency Tax Issues

Be careful! If you’re new to commuting or have switched jobs, you might be put on an emergency tax code, like 1257L W1 or M1. This can lead to overtaxing, especially if your employer doesn’t have your full tax history. In 2025/26, the standard personal allowance is £12,570, with income above that taxed at 20% up to £50,270. An emergency tax code might assume you earn more, docking extra tax from your pay. If this happens, contact HMRC to correct your tax code pronto. You could be due a refund, especially if your commute-related expenses (like temporary workplace travel) weren’t factored in. Use the GOV.UK tool at www.gov.uk/check-income-tax-current-year to check your tax code and estimate refunds.

Real-Life Example: Elowen’s Story

Let me tell you about Elowen, a High Wycombe-based graphic designer. In 2024, she took a nine-month contract with a London agency, commuting three days a week by train. Her employer didn’t cover her £120 weekly train fare, but because the London office was a temporary workplace, she claimed tax relief on £4,320 (36 weeks x £120). As a higher-rate taxpayer (40%), she saved £1,728 in tax. Elowen kept digital tickets and a letter from her employer confirming the temporary role, which made her HMRC claim smooth as butter. Moral of the story? Documentation is your best friend.

Why This Matters for High Wycombe Commuters

High Wycombe to London is one of the UK’s pricier commutes, with train fares eating up a chunk of your income. With the average UK salary around £34,963 in 2025 (based on ONS data), a £5,500 season ticket is a whopping 16% of pre-tax earnings for many. Knowing when and how to claim tax relief can make a real difference, especially if you’re in a temporary role or have unique work expenses.

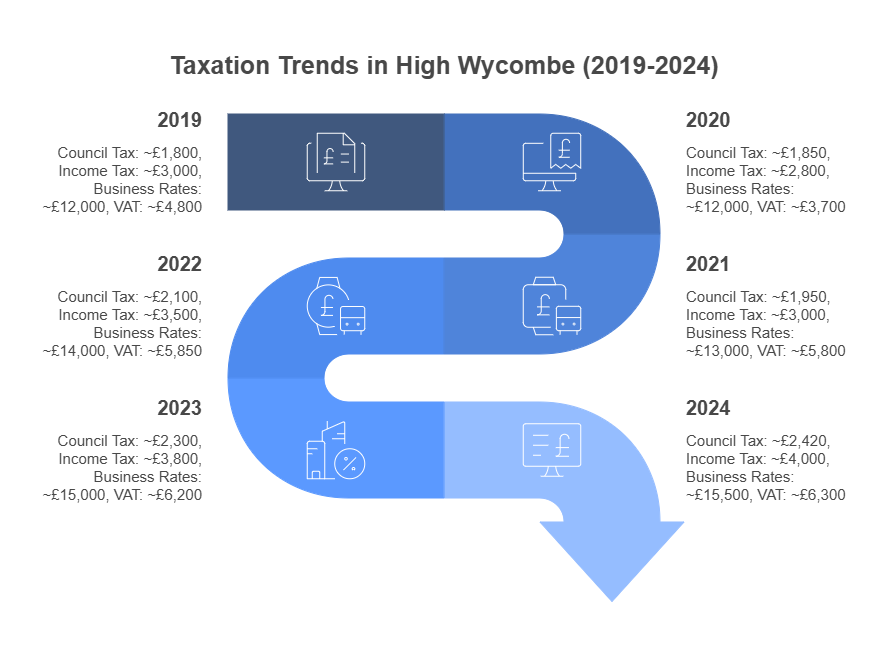

Pls. NOTE: These are only the average trends of different types of taxes in High Wycombe, not the absolute data.

Navigating HMRC Rules and Maximising Tax Relief for Your Commute

Right, so you’ve got the basics of when you can and can’t claim tax relief for your High Wycombe to London commute. Now let’s dig deeper into the nitty-gritty of HMRC’s rules and how you can make the most of them without getting tangled in red tape. The goal here is to arm you with practical know-how to spot every opportunity for tax savings, avoid common pitfalls, and keep your paperwork bulletproof. Whether you’re a PAYE employee or a self-employed business owner, there’s plenty to unpack for the 2025/26 tax year.

Temporary Workplaces: Getting the Details Right

Let’s start with the big one: temporary workplaces. If your London job isn’t your usual workplace, you might be eligible for tax relief on travel costs, but HMRC is picky about definitions. A temporary workplace is somewhere you attend for less than 24 months or 40% of your working time. For example, if you’re a High Wycombe-based project manager sent to a London office for a 12-month contract, your train fares or mileage qualify. But here’s the kicker: if you know from the outset that the role will last longer than 24 months, HMRC considers it permanent, and no relief applies. Keep a paper trail—contracts, emails, or timesheets—to prove the temporary nature of the gig. Without this, HMRC might reject your claim faster than you can say “season ticket.”

Claiming Mileage for Business Travel

Now, if you’re driving from High Wycombe to London for work, mileage claims can be a game-changer. Say you’re a self-employed consultant visiting clients in the City. You can claim 45p per mile for the first 10,000 business miles and 25p per mile after that, as per HMRC’s 2025/26 AMAP rates. The round-trip is about 60 miles, so a single trip nets you £27 in tax-deductible expenses (60 x 45p). If you make 100 such trips in a year, that’s £2,700 off your taxable income. For a basic rate taxpayer (20%), that’s a £540 tax saving. Here’s a quick breakdown for different commuting frequencies:

| Trips per Year | Total Miles | Relief at 45p/mile | Tax Saved (20%) |

|---|---|---|---|

| 50 | 3,000 | £1,350 | £270 |

| 100 | 6,000 | £2,700 | £540 |

| 150 | 9,000 | £4,050 | £810 |

Keep a logbook with dates, destinations, and purposes of each trip. Apps like MileIQ or Everlance can help track mileage automatically, saving you from scribbling notes on the back of receipts.

Public Transport Claims: What’s Allowed?

So, what about those pricey train tickets? If you’re commuting to a temporary workplace, you can claim the full cost of your fares, provided your employer doesn’t reimburse you. For instance, a weekly train ticket from High Wycombe to London costs about £120 in 2025. If you’re on a six-month contract (24 weeks), that’s £2,880 in fares. As a higher-rate taxpayer (40%), claiming this could save you £1,152 in tax. But here’s where it gets tricky: you need to show the trips were strictly for work. Season tickets are tougher to claim because they often cover personal travel too, so HMRC might ask for a breakdown of business vs. personal use. Pro tip: buy single or return tickets for specific work trips and keep digital records via apps like Trainline.

Tax Relief for Other Commuting Costs

Don’t overlook the little things! If your commute involves extra costs like parking fees at London stations or bike maintenance for cycling to High Wycombe station, these might be deductible if tied to a temporary workplace. For example, parking at Marylebone can cost £10-£20 daily. If you park 50 times a year for work, that’s up to £1,000 you could claim. Same goes for subsistence—like meals bought during long workdays away from your usual workplace. HMRC allows “reasonable” subsistence claims, but don’t try claiming your Pret coffee for a regular commute—it won’t fly.

Self-Employed vs. PAYE: Different Rules Apply

Now, here’s a heads-up: tax relief rules differ depending on whether you’re self-employed or PAYE. If you’re self-employed, you claim travel expenses through your Self Assessment tax return, deducting them directly from your taxable profits. For PAYE employees, it’s trickier—you’ll need to claim relief via a P87 form or by writing to HMRC. If your employer reimburses some costs, those payments are tax-free up to HMRC’s approved rates, but anything over is taxed as a benefit-in-kind. For example, if your employer pays you 50p per mile when the AMAP rate is 45p, the extra 5p per mile is taxable. Check your payslips to avoid surprises.

Avoiding HMRC Pitfalls

Be careful! HMRC audits travel expense claims closely, especially for commuters. Common mistakes include claiming for regular commutes (not allowed) or lacking evidence. One High Wycombe nurse, Jago, learned this the hard way in 2024. He claimed £3,000 in train fares for his London hospital job, assuming it was temporary. HMRC rejected it because his contract was open-ended, making it a permanent workplace. Jago lost out because he didn’t have a clear contract specifying a fixed term. To avoid this, always double-check your employment terms and keep records like train tickets, fuel receipts, or client emails.

Step-by-Step Guide to Claiming Tax Relief

Here’s a practical guide to get your tax relief sorted:

- Confirm Eligibility: Check if your London workplace is temporary (under 24 months or 40% of your time). If it’s your permanent workplace, stop here—relief isn’t available.

- Gather Evidence: Collect receipts, tickets, or mileage logs. For temporary roles, get a contract or employer letter confirming the duration.

- Calculate Costs: For mileage, use HMRC’s AMAP rates (45p/mile up to 10,000 miles). For public transport, tally ticket costs for business trips only.

- Submit Your Claim: Self-employed? Include expenses in your Self Assessment by 31 January 2026. PAYE? Use HMRC’s P87 form online or post it.

- Check Your Tax Code: Ensure your tax code reflects any relief, especially if you’re correcting overtaxing. Use www.gov.uk/check-income-tax-current-year to verify.

- Keep Records: Store all documents for at least 22 months after the tax year ends in case HMRC asks questions.

Why This Matters for You

High Wycombe commuters face some of the steepest travel costs in the UK, with train fares rising 4.9% in 2025, according to industry estimates. Knowing how to claim every allowable expense can save you hundreds, if not thousands, annually. Whether it’s mileage, train tickets, or parking, the key is understanding HMRC’s rules and keeping meticulous records.

Advanced Strategies and Tax-Efficient Travel Options for High Wycombe Commuters

Alright, you’re now clued up on the basics of tax relief and how to navigate HMRC’s rules for your High Wycombe to London commute. But let’s take it up a notch. There are clever ways to make your commute more tax-efficient, from tapping into employer schemes to exploring lesser-known reliefs. This part is all about giving you practical, actionable strategies to keep more money in your pocket, whether you’re a PAYE employee or running your own business. We’ll also look at real-world examples and dig into some quirks of the 2025/26 tax system that could work in your favour.

Employer Travel Schemes: A Hidden Gem

Now, here’s something you might not have thought about: employer-provided travel schemes. Some companies in London offer tax-efficient perks to ease the commuting burden, especially for High Wycombe folks facing hefty train fares. One standout is the season ticket loan scheme. Your employer might offer an interest-free loan to cover your annual train ticket—around £5,500 for High Wycombe to London in 2025. The loan is repaid through salary deductions, spreading the cost over the year. While the ticket itself isn’t tax-deductible, the interest-free loan is a tax-free benefit, saving you compared to borrowing elsewhere. Check your employee handbook or ask HR if this is an option—it’s surprisingly underused.

Cycle to Work Scheme: Pedal Your Way to Savings

If you’re up for a bit of exercise, the Cycle to Work scheme could be a winner. Here’s how it works: your employer buys a bike and gear (up to £1,000, or more if they’re generous), and you “hire” it through salary sacrifice. This reduces your taxable income, saving you tax and National Insurance. For a basic rate taxpayer (20% tax, 12% NI), a £1,000 bike could save you £320. You could cycle from your High Wycombe home to the station, park the bike, and train into London, cutting parking or bus costs. In 2024, a High Wycombe teacher, Morwenna, used this scheme to buy a £900 e-bike, saving £288 in tax and NI while dodging £500 in annual station parking fees. Check GOV.UK’s guidance at www.gov.uk/government/publications/cycle-to-work-scheme for eligibility.

Salary Sacrifice for Other Travel Costs

Let’s talk salary sacrifice again, because it’s not just for bikes. Some employers let you sacrifice part of your salary for travel-related benefits, like discounted train tickets or parking passes. The sacrificed amount comes out pre-tax, lowering your tax bill. For example, if you sacrifice £1,000 of your salary for a discounted season ticket, a basic rate taxpayer saves £320 (20% tax + 12% NI). The catch? Not all employers offer this, and it reduces your take-home pay, which could affect pension contributions or mortgage applications. Run the numbers with your HR team to see if it’s worth it.

Working from Home Allowance: A Commuter’s Sidekick

Now, consider this: if you’re hybrid working—say, three days in London and two at home—you might qualify for the working from home allowance. HMRC allows £6 per week (£312/year) tax-free if your employer requires home working, no receipts needed. For a basic rate taxpayer, that’s a £62 tax saving. If your employer pays more than £6 weekly, the excess is taxable, so clarify with your payroll team. This won’t cover your train fares, but it can offset other commuting costs, like broadband or heating. In 2025, with energy bills averaging £1,800 annually (per Ofgem), this small relief adds up.

Tax Relief for Business Trips Beyond London

Don’t forget about business trips! If your London job involves further travel—say, to a client in Birmingham—you can claim tax relief on those costs, even as a PAYE employee. For example, if you drive from High Wycombe to a client meeting in Reading (40 miles round-trip), you can claim £18 per trip (40 x 45p). If your employer reimburses you at a lower rate (say, 30p/mile), you can claim the difference (15p/mile) via a P87 form. Keep a detailed log: date, destination, client name, and purpose. A 2024 case saw a High Wycombe marketing consultant, Tamsin, claim £1,200 in extra mileage for client visits, saving £480 as a higher-rate taxpayer.

Tax Implications of Company Cars

Got a company car? Be careful! If your employer provides a car for your High Wycombe to London commute, it’s a taxable benefit unless used exclusively for business. The tax charge depends on the car’s CO2 emissions and list price. For a mid-range electric car (1-50g/km CO2) in 2025/26, the benefit-in-kind (BIK) rate is around 2-14%, per HMRC. For a £30,000 car, that’s a taxable benefit of £600-£4,200 annually. A basic rate taxpayer would pay £120-£840 in tax. If you’re only using it for business trips (not commuting), you can claim mileage relief instead, avoiding BIK tax. Check your car’s usage with your employer to stay compliant.

Tax Savings Breakdown for Commuters

Here’s a table summarising potential tax savings for a High Wycombe commuter in 2025/26, assuming a basic rate taxpayer (20% tax, 12% NI):

| Scheme/Relief | Annual Cost/Value | Tax Saving |

|---|---|---|

| Cycle to Work (£1,000 bike) | £1,000 | £320 |

| Working from Home (£6/week) | £312 | £62 |

| Mileage (100 trips, 60 miles) | £2,700 | £540 |

| Season Ticket Loan (Interest) | £200 (est. saving) | £64 |

These savings depend on your circumstances, so always double-check eligibility with HMRC’s guidance at www.gov.uk/tax-relief-for-employees.

Hybrid Working and Tax Planning

So, the question is: how does hybrid working affect your tax strategy? If you’re splitting time between home, High Wycombe, and London, you can mix and match reliefs. For instance, combine the working from home allowance with mileage claims for occasional London trips. A 2023 case involved a High Wycombe accountant, Lowen, who worked two days at home and three in London. He claimed £312 for home working and £1,800 in mileage for 60 client trips, saving £624 in tax. The key? He kept a diary of work locations and travel purposes, which HMRC accepted without fuss.

Staying Ahead of HMRC Changes

Now, it shouldn’t surprise you that HMRC tweaks rules regularly. In 2025/26, there’s talk of tighter scrutiny on travel claims due to hybrid working trends, per recent HMRC consultations. Stay updated via GOV.UK or subscribe to HMRC’s email alerts. Also, watch out for overtaxing if your employer changes your work pattern mid-year—check your tax code at www.gov.uk/check-income-tax-current-year to avoid paying more than you owe.

How a Tax Accountant in High Wycombe Can Help with Commuter Tax Management

So, you’ve been slogging through the ins and outs of tax relief for your High Wycombe to London commute, and it’s probably feeling like a bit of a maze. HMRC’s rules are no walk in the park, and keeping track of mileage logs, train tickets, and temporary workplace criteria can make your head spin. This is where a local tax accountant, like the team at Total Tax Accountants in High Wycombe, can step in and save the day. In this final part, we’ll explore how a professional can help you navigate the complexities of commuter tax relief, ensure you’re not overpaying, and maximise your savings for the 2025/26 tax year. Plus, we’ll dive into a detailed case study to show how it works in real life.

Why You Need a Tax Accountant for Commuting Costs

Let’s be honest: none of us is a tax expert by default, and HMRC’s guidance can feel like it’s written in another language. A tax accountant doesn’t just crunch numbers—they translate the jargon into plain English and spot opportunities you might miss. For High Wycombe commuters, this means ensuring you’re claiming every allowable expense, from mileage for temporary workplaces to niche reliefs like uniform allowances. Total Tax Accountants, based right in High Wycombe (check them out at www.totaltaxaccountants.co.uk), specialise in local tax issues, so they know the challenges of commuting to London inside out. They’ll review your employment status, travel patterns, and expenses to build a tailored plan that keeps you compliant and saves you cash.

Sorting Out Temporary Workplace Claims

Now, consider this: if you’re commuting to a temporary workplace in London, a tax accountant can make sure your claim is watertight. They’ll verify that your role meets HMRC’s 24-month or 40% rule, help you gather evidence like contracts or client emails, and calculate the exact relief you’re due. For example, if you’re driving 60 miles round-trip for a six-month project, they’ll tally your mileage at 45p per mile (up to 10,000 miles) and ensure it’s correctly reported on your Self Assessment or P87 form. They can also spot if your employer’s reimbursement is taxable and adjust your claim to avoid overpaying. This kind of precision is gold when HMRC comes knocking.

Fixing Tax Code Mishaps

Be careful! Commuters often get hit with incorrect tax codes, especially if you’re new to a job or juggling multiple roles. An emergency tax code like 1257L W1 can overtax you, eating into your take-home pay. In 2025/26, with the personal allowance at £12,570, a wrong code could cost you hundreds. A tax accountant will check your payslips, liaise with HMRC to correct your code, and chase any refunds. Total Tax Accountants has a knack for spotting these errors, especially for High Wycombe residents who might switch between London-based temporary contracts and local work, which can confuse PAYE systems.

Maximising Self-Employed Deductions

If you’re self-employed, a tax accountant is your best mate. They’ll ensure you’re claiming every allowable expense—train fares, mileage, parking, even subsistence for business trips. For instance, if you’re a High Wycombe freelancer commuting to London for client meetings, they’ll help you log expenses accurately and deduct them from your taxable profits on your Self Assessment. They can also advise on structuring your business to minimise tax, like using a limited company to claim travel costs more efficiently. Total Tax Accountants has helped local freelancers save thousands by catching overlooked deductions, like bike maintenance under the Cycle to Work scheme.

Hybrid Working and Complex Scenarios

So, the question is: what if your work pattern is a bit of a jumble? Maybe you’re hybrid working—two days at home, three in London—or splitting time between multiple clients. A tax accountant can untangle this mess. They’ll assess which expenses qualify (like working from home allowances) and ensure you’re not double-dipping on claims. They can also advise on salary sacrifice schemes or season ticket loans, calculating whether they’re worth it for your tax bracket. For High Wycombe commuters, where train fares hit £5,500 annually, this kind of bespoke advice is crucial to avoid missing out.

Case Study: Tegen’s Tax Triumph

Let’s talk about Tegen, a 32-year-old High Wycombe-based project coordinator who contacted Total Tax Accountants in early 2024. Tegen had a complex setup: she worked three days a week at a temporary London office (an 18-month contract), one day at home, and one day at a client’s site in Slough. Her annual train fares to London totalled £3,600, and she drove 4,000 miles for client visits. Tegen was also on an incorrect tax code (BR, not 1257L), costing her £800 in overpaid tax. She was clueless about claiming relief and overwhelmed by HMRC’s forms.

Total Tax Accountants, led by CEO Mr. Maz, stepped in. They:

- Verified Temporary Workplace Status: Confirmed her London role was temporary with a contract letter, making train fares eligible for relief.

- Calculated Mileage: Logged 4,000 miles at 45p/mile, claiming £1,800 in deductions.

- Corrected Tax Code: Contacted HMRC to fix Tegen’s tax code, securing an £800 refund for 2023/24.

- Claimed Home Working Allowance: Added £312 for home working, saving £62 (20% tax).

- Filed Claims: Submitted a P87 form for PAYE relief, ensuring all expenses were claimed correctly.

By April 2024, Tegen saved £2,110 in tax: £720 (train fares), £360 (mileage), £800 (tax code refund), and £62 (home working). Total Tax Accountants also set her up with a mileage tracking app and a checklist for 2025/26 claims, saving her hours of stress. Tegen’s case shows how a local accountant’s expertise can turn a tax headache into serious savings.

Beyond Commuting: Holistic Tax Planning

Now, it shouldn’t surprise you that a good accountant does more than just travel expenses. Total Tax Accountants can review your entire tax situation—pensions, investments, even side hustles—to ensure you’re not overpaying. For business owners, they can advise on VAT registration or R&D tax credits, which could apply if you’re developing new processes in your London gigs. They’ll also keep you updated on 2025/26 tax changes, like potential tweaks to mileage rates or hybrid working rules, so you’re never caught off guard.

Why Choose a Local High Wycombe Accountant?

Here’s the deal: a High Wycombe accountant like Total Tax Accountants gets the local vibe. They know the pain of Chiltern Railways fares and the A404 traffic, so they tailor advice to your reality. Their office is just a stone’s throw from High Wycombe station, making it easy to pop in for a chat. Plus, their team, led by Mr. Maz, has years of experience with commuters and local businesses, from sole traders to SMEs. They’re not just number-crunchers—they’re problem-solvers who know HMRC’s playbook.

Get in Touch with Total Tax Accountants

If you’re a High Wycombe commuter fed up with navigating tax relief alone, why not let the pros take the wheel? Total Tax Accountants offers a free initial consultation to review your commuting expenses and tax situation. Whether you’re PAYE, self-employed, or a business owner, their CEO, Mr. Maz, and his team can help you claim every penny you’re owed. Contact them at www.totaltaxaccountants.co.uk or give them a ring to book your free chat. Don’t let HMRC keep your hard-earned cash—get expert help and make your commute work for you.

FAQs

1. Q: Can you claim tax relief for commuting from High Wycombe to London if you work from home part-time?

A: If you work from home part-time and commute to a London office, you may claim tax relief for travel expenses only if the London office is a temporary workplace (less than 24 months or 40% of your work time). Additionally, you could claim the working from home allowance (£6/week) for home-based days, reducing taxable income by up to £312 annually in 2025/26.

2. Q: Are there any tax benefits for using an electric vehicle for commuting from High Wycombe to London?

A: If you use an electric vehicle for business-related trips to a temporary workplace, you can claim 45p per mile under HMRC’s AMAP rates for 2025/26. Company-provided electric cars have lower benefit-in-kind tax rates (2-14% depending on CO2 emissions), potentially saving you hundreds compared to petrol vehicles.

3. Q: Can you claim tax relief for commuting costs if you’re a contractor working in London?

A: As a contractor, you can claim tax relief on travel costs to a temporary workplace in London, provided the contract is under 24 months. For example, train fares or mileage (45p/mile) can be deducted from your taxable income via Self Assessment in 2025/26.

4. Q: How does the tax relief process differ for commuters using buses from High Wycombe to London?

A: Bus fares for commuting to a temporary workplace in London are eligible for tax relief, similar to train fares. You must keep receipts and prove the workplace is temporary. Submit claims via a P87 form (PAYE) or Self Assessment (self-employed) for 2025/26.

5. Q: Can you claim tax relief for commuting if your employer provides a travel allowance?

A: If your employer provides a travel allowance for a temporary workplace, it’s tax-free up to HMRC’s approved rates (e.g., 45p/mile for cars). Any excess is taxable as a benefit-in-kind. You can claim relief on unreimbursed costs via a P87 form.

6. Q: Are there tax relief options for High Wycombe commuters using carpooling to London?

A: Carpooling costs can be claimed as tax relief if the travel is to a temporary workplace and you’re covering expenses like fuel. Only the driver can claim mileage (45p/mile), but passengers may claim shared costs if documented as business expenses.

7. Q: Can you claim tax relief for commuting costs if you’re a part-time worker in London?

A: Part-time workers can claim tax relief for travel to a temporary workplace in London, such as train fares or mileage, provided the role meets HMRC’s temporary workplace criteria (under 24 months). Claims are proportional to your work frequency.

8. Q: How does tax relief work if you commute to multiple London workplaces?

A: If you commute to multiple temporary workplaces in London, you can claim travel costs (e.g., train fares or mileage) for each, provided none exceed 24 months or 40% of your work time. Keep detailed records to separate business from personal travel.

9. Q: Can you claim tax relief for accommodation costs if you stay overnight in London for work?

A: If your job requires overnight stays in London for a temporary workplace, you can claim reasonable accommodation costs as tax relief. For example, hotel expenses can be deducted via Self Assessment or a P87 form, provided you keep receipts.

10. Q: Are there tax relief benefits for High Wycombe commuters using a motorcycle to London?

A: Motorcycle commuters can claim tax relief at 24p per mile for business trips to a temporary workplace in London under HMRC’s 2025/26 AMAP rates. Keep a mileage log and proof of the temporary role to support your claim.

11. Q: Can you claim tax relief for commuting costs if you’re a student working part-time in London?

A: Students working part-time in London can claim tax relief for travel to a temporary workplace, such as train fares or mileage, if the job meets HMRC’s criteria. You’d claim via a P87 form if PAYE or Self Assessment if self-employed.

12. Q: How does tax relief apply if you commute to London for training courses?

A: Travel costs for work-related training in London, such as train fares or mileage, are tax-deductible if the training is necessary for your job. Claim these as business expenses via Self Assessment or a P87 form for 2025/26.

13. Q: Can you claim tax relief for commuting if you’re on a zero-hours contract in London?

A: Zero-hours contract workers can claim tax relief for travel to a temporary workplace in London, provided the role is under 24 months. You’ll need to prove the temporary nature with contracts or employer letters and claim via a P87 form.

14. Q: Are there tax relief options for High Wycombe commuters using taxis to London?

A: Taxi fares to a temporary workplace in London can be claimed as tax relief if they’re solely for business purposes. Keep receipts and document the work-related purpose, claiming via Self Assessment or a P87 form for 2025/26.

15. Q: Can you claim tax relief for commuting costs if you’re a freelancer with multiple clients in London?

A: Freelancers can claim travel costs to multiple temporary workplaces in London, such as train fares or mileage, as long as each client engagement is under 24 months. Deduct these expenses on your 2025/26 Self Assessment return.

16. Q: How does tax relief work for High Wycombe commuters with a disability?

A: If you have a disability requiring special transport (e.g., adapted vehicles or taxis) to a temporary workplace in London, these costs can be claimed as tax relief. Provide medical evidence and receipts when submitting your claim.

17. Q: Can you claim tax relief for commuting if you’re seconded to a London office?

A: If you’re seconded to a London office for under 24 months, travel costs like train fares or mileage qualify for tax relief as a temporary workplace expense. Claim via a P87 form or Self Assessment, with proof of the secondment duration.

18. Q: Are there tax relief options for High Wycombe commuters using ride-sharing apps to London?

A: Ride-sharing costs (e.g., Uber) to a temporary workplace in London can be claimed as tax relief if the trips are work-related. Keep digital receipts and document the business purpose for your 2025/26 claim.

19. Q: Can you claim tax relief for commuting costs if you’re a High Wycombe resident working in London temporarily due to a project?

A: Yes, travel costs to a temporary London workplace for a specific project (under 24 months) are tax-deductible. Claim train fares or mileage via a P87 form (PAYE) or Self Assessment (self-employed) for 2025/26.

20. Q: How does tax relief apply if you commute to London for a fixed-term contract?

A: Travel costs for a fixed-term contract in London (under 24 months) qualify for tax relief as a temporary workplace expense. For example, a £3,600 annual train fare could save a basic rate taxpayer £720 in tax if claimed correctly.