Understanding Capital Gains Tax on Buy-to-Let Properties in the UK

Capital Gains Tax (CGT) in the UK applies to the profit gained from selling assets, including buy-to-let properties. This tax is not levied on the total sale price but on the profit or ‘gain’ made over the amount you originally paid for the property. For instance, if a buy-to-let property was bought for £250,000 and sold for £500,000, CGT would apply to the £250,000 difference.

For the 2023-24 tax year, the CGT personal allowance is £6,000, significantly reduced from £12,300 in the previous year. This allowance is the amount of gain you can earn tax-free. Married couples or civil partners owning joint assets can combine their allowances, potentially allowing a gain of £12,000 without incurring any tax.

CGT rates vary based on your income tax band. For basic-rate taxpayers (those earning up to £50,000 annually), the CGT rate is 18%, while for higher-rate taxpayers, it’s 28%. It’s crucial to note that the profit from the sale of your property will be added to your income, potentially pushing basic-rate taxpayers into the higher-rate tax band, thereby affecting the CGT rate applied.

Understanding these basics is essential in strategizing to minimize CGT on buy-to-let properties. One crucial aspect is being aware of allowable costs that can be offset against CGT. These include stamp duty from the original purchase, solicitor and estate agent fees from the property sale, and costs for capital improvements to the property. However, expenses for property upkeep or mortgage interest cannot be deducted.

Strategies to Minimize Capital Gains Tax

While completely avoiding CGT on buy-to-let properties is unlikely, several strategies can help reduce the tax bill. First, making the most of your tax-free CGT allowance is crucial. As of the 2021-22 tax year, every individual has a £12,300 allowance, which cannot be carried forward. For married couples or civil partners, combining their allowances can double the tax-free limit to £24,600.

Transferring property ownership to a spouse, especially if they are in a lower tax band, can also be a strategic move to reduce CGT liability. Moreover, setting up a limited company for property investments can be beneficial, especially for higher-rate taxpayers. In this scenario, profits from property sales are subject to corporation tax, currently at 19%, rather than the 28% CGT rate applicable to high-earning individuals.

Private Residence Relief (PRR) offers significant benefits if you have lived in your buy-to-let property as your primary residence before selling it. PRR allows for tax relief for the period you lived in the property and an additional nine months prior to the sale. Similarly, Lettings Relief can apply if you shared the property with a tenant, potentially offering up to £40,000 relief.

Another consideration is the timing of the property sale. If you have already used all or part of your CGT allowance in a tax year, delaying the sale to the next tax year when your allowance is replenished can be a smart move.

Legal Considerations and Reporting Requirements

It’s essential to understand the legal intricacies and reporting requirements associated with CGT on buy-to-let properties. Firstly, it’s important to note that buying another property with the proceeds from the sale of a buy-to-let property does not qualify for business asset roll-over relief, as HMRC does not consider investing in buy-to-let properties as ‘trading’. However, this relief is available for furnished holiday lettings under specific conditions.

Calculating the CGT payable involves adding up your total taxable earnings to determine your income tax band, then deducting the sale price from the purchase price, your remaining capital gains tax allowance, and any allowable costs and expenses. Your income will determine the CGT rate applicable to the gain.

Finally, it’s crucial to adhere to the timeline for CGT payment. The CGT bill on buy-to-let property must be paid within 30 days of the sale’s completion, alongside submitting a capital gains tax return. If you pay income tax through self-assessment, this liability must also be included in your annual return.

In conclusion, while avoiding CGT on buy-to-let properties entirely may not be feasible, understanding the rules, leveraging available allowances and reliefs, and strategic planning can significantly reduce your tax liability. Always consider seeking professional advice to navigate the complexities of CGT and ensure compliance with all legal and financial obligations.

Avoiding Capital Gains Tax on Buy-to-Let Property in the UK: A Step-by-Step Strategy

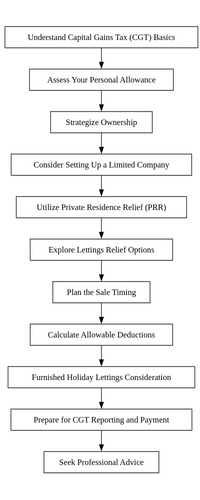

1. Understand Capital Gains Tax (CGT) Basics:

- Learn about CGT and how it applies to profits from selling buy-to-let properties.

- Familiarize yourself with the current CGT rates for different income bands.

2. Assess Your Personal Allowance:

- Determine your CGT personal allowance for the current tax year.

- For joint property owners, like married couples or civil partners, consider combining your allowances.

3. Strategize Ownership:

- If in a partnership or marriage, consider transferring the property, or a portion of it, to the partner in a lower tax band.

- This can reduce the overall CGT liability when the property is sold.

4. Consider Setting Up a Limited Company:

- Explore the feasibility of holding your buy-to-let properties in a limited company.

- Profits from sales within a company are subject to corporation tax, which may be lower than personal CGT rates for higher earners.

5. Utilize Private Residence Relief (PRR):

- If applicable, use PRR by making the buy-to-let property your main residence for a period.

- Understand the rules and time frames for PRR to maximize its benefits.

6. Explore Lettings Relief Options:

- If you shared occupancy with a tenant, check if you qualify for Lettings Relief, which can further reduce CGT.

7. Plan the Sale Timing:

- Consider the timing of the sale, especially if you’ve already used some or all of your CGT allowance in the current tax year.

- Delaying the sale to the next tax year might optimize your tax-free allowance usage.

8. Calculate Allowable Deductions:

- Deduct allowable costs from your gain, including stamp duty, solicitor fees, estate agent fees, and costs of capital improvements to the property.

9. Furnished Holiday Lettings Consideration:

- If relevant, consider converting your buy-to-let into a furnished holiday let to potentially qualify for business asset roll-over relief.

10. Prepare for CGT Reporting and Payment:

- Ensure timely reporting and payment of CGT within the required 30 days of the sale’s completion.

- Include CGT liability in your self-assessment tax return if applicable.

11. Seek Professional Advice:

- Before implementing any strategy, consult with a tax professional.

- Professional advice is crucial to ensure compliance with tax laws and to tailor strategies to your specific circumstances.

Remember, while these strategies can help in minimizing CGT, completely avoiding it may not always be feasible or legal. It’s essential to adhere to HMRC regulations and seek expert advice for effective tax planning.

Avoiding Capital Gains Tax on Buy-to-Let Property in the UK: A Step-by-Step Strategy

How a Tax Accountant Can Help You with Your Capital Gains Tax on Buy-to-Let Property in the UK

Navigating the complexities of Capital Gains Tax (CGT) on buy-to-let properties in the UK can be a daunting task for property owners. This is where the expertise of a tax accountant becomes invaluable. A tax accountant can provide tailored advice, ensure compliance with tax laws, and help you optimize your tax position. Here’s how they can assist:

Understanding Capital Gains Tax and Its Implications

A tax accountant can explain the intricacies of CGT, including how it applies to your buy-to-let property. They will help you understand the current CGT rates, how they affect your profits, and the impact of your tax band on these rates. This foundational knowledge is crucial for effective tax planning.

Assessing Personal Allowances and Reliefs

Every individual in the UK has an annual CGT allowance. A tax accountant can help you calculate your personal allowance and advise on how to use it effectively. For joint property owners, they can guide on combining allowances to maximize benefits. Additionally, they can help you understand and apply for reliefs such as Private Residence Relief (PRR) and Lettings Relief, which can significantly reduce your CGT liability.

Strategic Ownership and Property Transfers

If you own a property jointly with a partner, a tax accountant can advise on the benefits of transferring a portion of the property to the partner in a lower tax band. This strategy can reduce the overall CGT liability when the property is sold. They can also guide you through the legal and tax implications of such transfers.

Setting Up a Limited Company

For some property owners, holding buy-to-let properties in a limited company can be more tax-efficient. A tax accountant can analyze your situation to determine if this is a viable option for you, considering factors like corporation tax rates versus personal CGT rates.

Optimizing Sale Timing and Deductions

The timing of your property sale can have significant tax implications. A tax accountant can advise on the best time to sell, considering your current and future tax allowances. They can also help you identify and calculate allowable deductions such as stamp duty, solicitor fees, and costs of capital improvements, which can reduce your taxable gain.

Furnished Holiday Lettings Consideration

Converting your buy-to-let property into a furnished holiday let can offer different tax benefits. A tax accountant can provide insights into this option and its eligibility criteria, helping you make an informed decision.

CGT Reporting and Payment

Tax accountants ensure that you comply with the reporting and payment requirements for CGT. They can assist in preparing and submitting the necessary documents within the 30-day deadline following the sale of the property. This includes integrating the CGT liability into your self-assessment tax return if applicable.

Seeking Professional Advice

A tax accountant will offer personalized advice, considering your unique circumstances. They stay updated with the latest tax laws and regulations, ensuring that your tax planning strategies are both effective and compliant.

Conclusion

In summary, a tax accountant plays a pivotal role in managing your CGT liabilities on buy-to-let properties. Their expertise in tax laws, personalized advice, and strategic planning can lead to significant tax savings and peace of mind. While it’s possible to navigate CGT on your own, the complexity and potential financial implications make the investment in professional advice worthwhile. Remember, effective tax planning is not just about compliance; it’s about optimizing your financial position in line with current regulations.