A Guide to the Changes to the Temporary VAT Rate Cut for Hospitality and Tourism

Check out our updated Guide to Temporary VAT Rates for the UK Hotel and Tourism Industry. Understand the temporary VAT cut, the new renewal date, who will be affected, and what to do next.

Why the VAT Rate Was Temporarily Changed For Some Companies?

Lockdown conditions have been enforced to slow the global and national spread of the COVID-19 coronavirus. Unfortunately, this has been a significant disruption for companies that rely on social interaction, such as the real estate and hospitality sectors. To help them recover, the government is introducing several measures as part of its plan to recover from COVID-19.

In July 2020, the government announced that it would temporarily VAT rate cut for the tourism and hospitality sector from 20% to 5% to stimulate customer demand and support the industry.

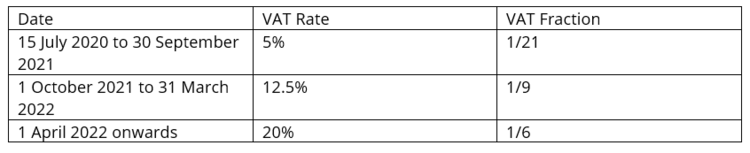

After September 30, 2021, the provisional Temporary VAT rate is expected to increase to 12.5% by March 31, 2022, as the sector and economy recover, and after March 31, 2022, it is expected that the rate returns to 20%. The scope of the reduced rate does not change (catering, hotel, and holiday accommodation, as well as entry to certain attractions).

Get VAT Consultancy Now!

When Does the Temporary VAT Rate Start and End?

The temporary VAT rate cut came into effect on July 15, 2020. It was originally scheduled to end on January 12, 2021, and was extended to March 31, 2021, for eligible companies.

Will the Lowering Of The Temporary VAT Rate Affect The Fixed-Rate VAT System?

If yes. Temporary changes mean that some rates that fall under the Fixed Rate Tax System (FRS) have changed. This enables VAT NIF users to benefit from the temporary lowering of the standard Temporary VAT rate. HMRC is updating the list of fixed VAT rates to reflect the temporary reduction.

Who Will Be Affected By The Temporary VAT Rate Change?

The VAT reduction affects companies and their customers that are subject to VAT in certain sectors. The government describes it as beneficial:

If you “delivered” the items listed below between July 15, 2020, and September 30, 2021, you will have to charge 5% VAT. Between October 1, 2021, and March 31, 2022, a VAT of 12.5% will be charged.

- Food or non-alcoholic drinks that are sold and consumed on-site (e.g. restaurants, cafes and pubs)

- Hot takeaway and soft drinks.

- Sleeping accommodations that include hotels and B & Bs or similar

- Vacation Rentals

- Pitch prices for caravans and tents and associated facilities

Get VAT Consultancy Now!