Businesses are usually run by the directors of the Company there are many pieces of legislation that

must be understood for the smooth operation of the business among them, the most commonly

The observed classification of the financial statements is Director Loan Account (DLA).

What is Director Loan Account?

Director loan is the amount received by the director which is not received against compensation of services i.e salary income, dividend income, reimbursement of expenses on account of performing any duty or the amount received which is previously paid as a loan to the Company.

Impact on Taxation

At the end of the financial year there would be tax implication on loan which may be either way i.e Loan received from the Company or on Loan paid to the Company

Exemption Limit for Director Loan

Director may need to withdraw cash in case of emergency needs but there is a limit to such withdrawal otherwise they would be treated as benefit in kind and would be subject to taxation, maximum limit for loan is £10,000 (£5000 in 2013-14).

Director Liability in Case of Loan from Company

If the Loan obtained from the Company remain within the exemption limit i.e £10,000 there would be no tax liability on it, only liability is to report as loan in self-assessment return.

Records to Be Maintain

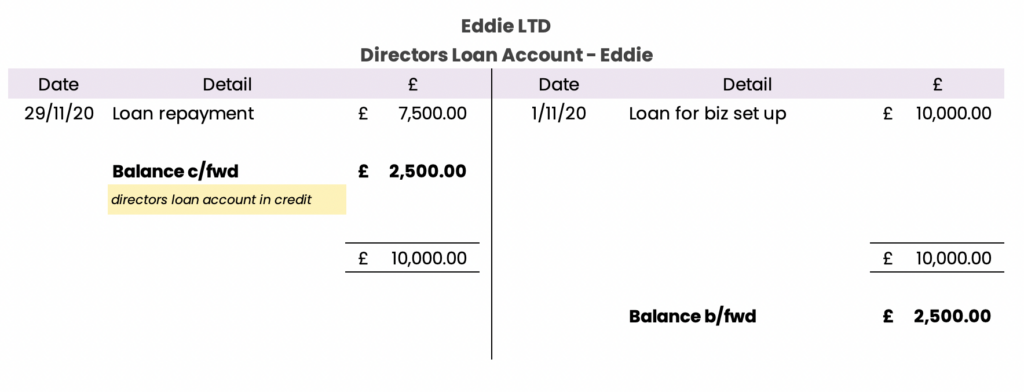

Director must maintain a complete record of the following

Loan obtained from the company

Loan repaid during the financial year

Interest paid during the year to Company on loan

Discounted interest charged by the Company on loan.

Interest Received in case of loan to Company.

Tax deducted by the Company on interest charged. i.e 20% of amount accrued

CT61 form of the quarter reported must be accompanied by supporting documents

Maximum Period of Loan

HMRC has prescribed limit for Corporation tax that will be paid subject to time period of utilization of

cash following example would be helpful in understanding the calculation

The sum of tax paid at 32.5% can be reclaimed, but only after the full loan has been repaid to the company.

Furthermore, it can only be reclaimed 9 months and 1 day after the end of the financial year in which you repaid all the loan to the company. Elsa borrows £10,000 on 11th June 2020 and his company’s financial year-end is 31st September 2020. Elsa will have until 1st July 2021 to repay the loan. If she does not pay by 1st July 2021, the company has to pay 32.5% of £10,000 as a tax which is £3250, however Elsa can claim this tax of £3250 after settlement of complete this may impact a temporary outflow to Elsa. Further if Elsa does not repay loan by July 1st, 2022 interest will be added in corporation tax which cannot be claimed back.

In rare circumstances if director does not pay back loan or it is written of the Company, the loan should be reported in class one insurance and contribution shall be paid through Company Payroll.

Time Period for Reclaim of Corporation Tax

Maximum period for claiming this corporation tax is within 4 years (or 6 years if the loan was repaid on or before 31 March 2010).

If you’re reclaiming 2 years or more after the end of the accounting period when the loan was taken out, fill in form L2P and either include it with your latest Company Tax Return or post it separately.

HMRC will pay the amount while using latest detail of Company tax return or through cheque separately to the Companies registered address.

Loan Paid to the Company

The most commonly observed second scenario would be the loan paid by the director to Company to fulfill the financial obligation or to temporarily bridge the working capital requirement for the Company, director may charge on such loan which will be

- a business expense for your company

- personal income for you

The income must be reported by director in income Self-Assessment Tax Return

Liability of Company in Case of Director’s Loan Liability

Company should deduct tax while making payment on account of interest at the basic rate of 20% and report these payment on quarterly basis on form CT61 which can be downloaded from HMRC websites online or for convenience can be get through call at HM Revenue and customs.

Conclusion

It is advisable that for a director to obtain a loan within the prescribed limit of £10,000 to avoid hefty taxes that may be reclaimed but still result in a financial burden on current cash outflow in financing activity section of financial statement, one must obtained professional advice before obtaining /repaying the loan as scenario may be vary depending on each case that may not be explained in particular.